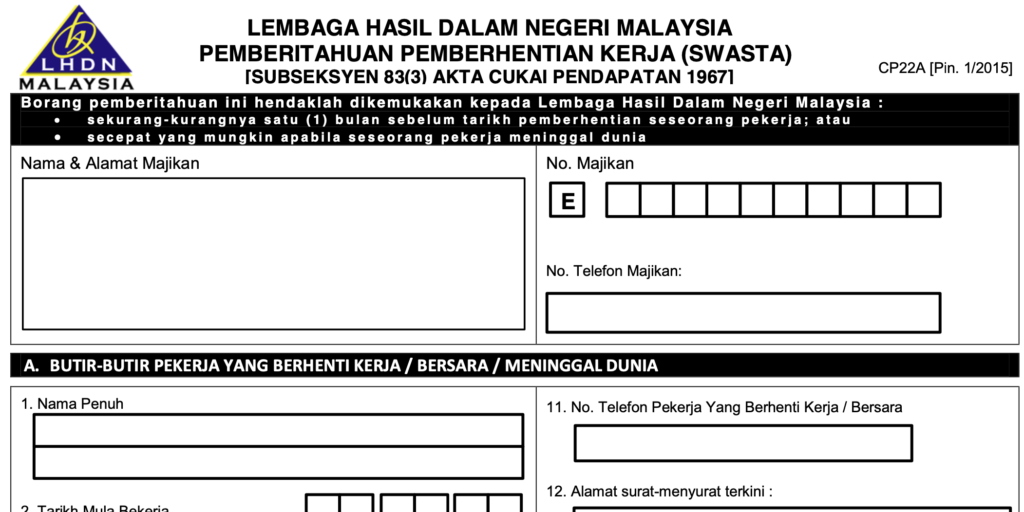

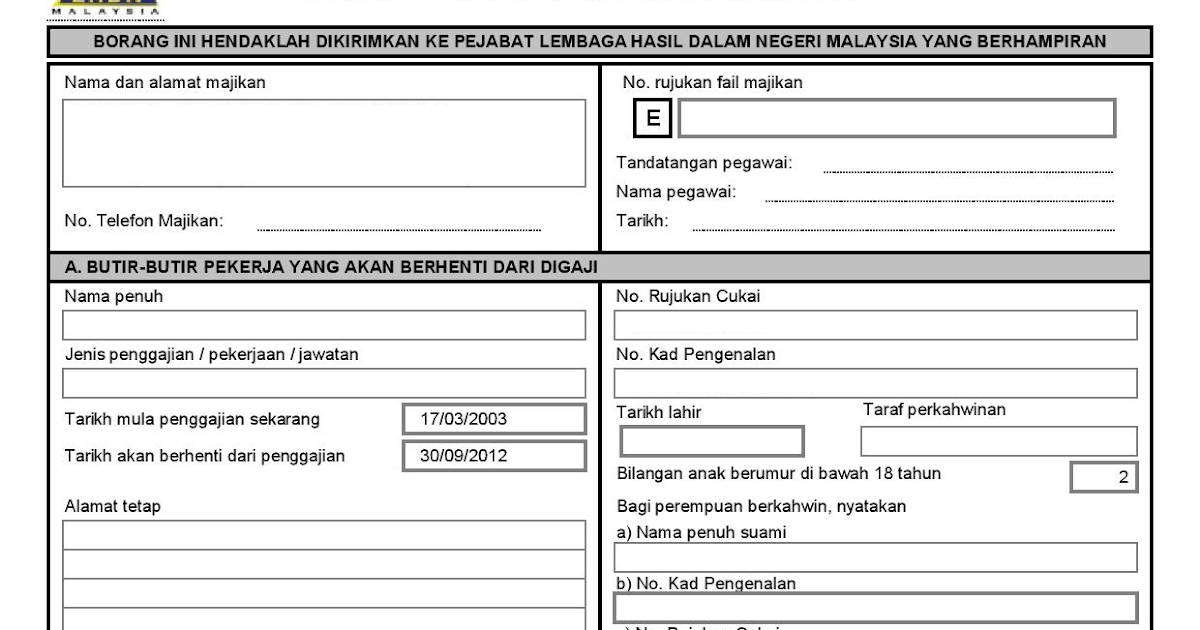

Form Cp22a Malaysia

Cp22a notification of cessation of employment employment of private sector employees b.

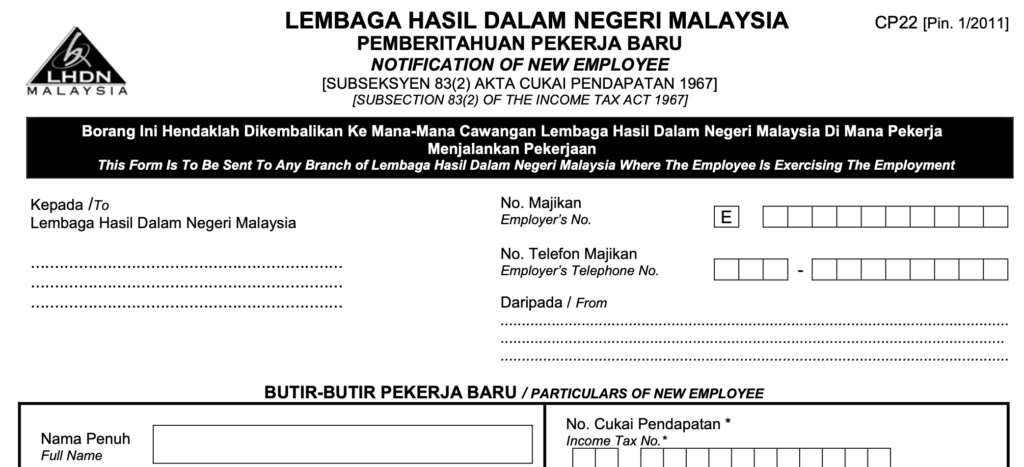

Form cp22a malaysia. Employer is aware that the employee is to be employed elsewhere in malaysia. Employer is aware that the employee is to be employed elsewhere in malaysia. It is advisable to submit form cp22 to notify irbm for all newly recruited staff within 1 month from the date of commencement. Guideline for personal tax clearance form cp21 cp22a cp22b as an employer are you aware of the reporting obligations under the malaysian income tax act 1967.

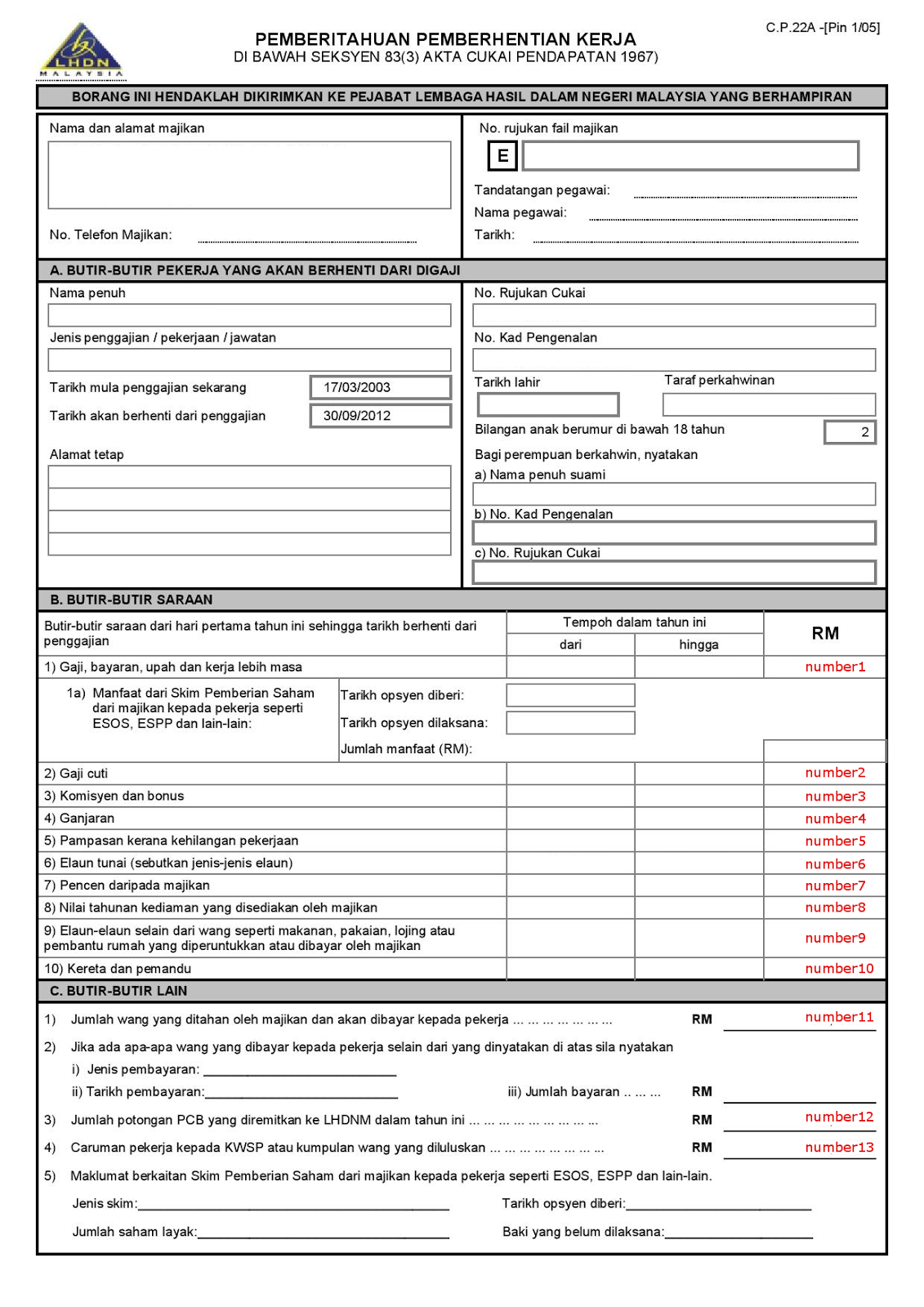

Employer is aware that the employee is to be employed elsewhere in malaysia. Cp 22b tax clearance form for cessation of employment of public sector employees. This form can be downloaded and submitted to lembaga hasil dalam negeri malaysia. It is important to understand the obligations under the law as these obligations are mandatory and failure to comply with these obligations would result in penalties to be imposed.

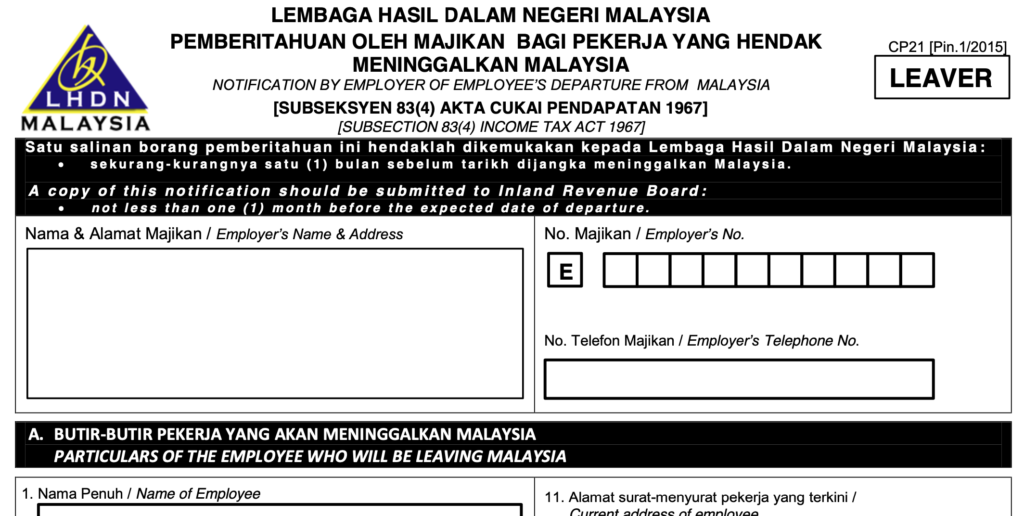

Lembaga hasil dalam negeri malaysia pemberitahuan oleh majikan bagi pekerja yang hendak meninggalkan malaysia notification by employer of employee s departure from malaysia subseksyen 83 4 akta cukai pendapatan 1967 subsection 83 4 income tax act 1967 cp21 pin 1 2015 e e leaver tarikh mula bekerja date of commencement malaysia. The employee is about to leave malaysia permanently in this case form cp21 would be submitted instead of form cp22a. Daripada from. Lembaga hasil dalam negeri malaysia pemberitahuan pemberhentian kerja swasta subseksyen 83 3 akta cukai pendapatan 1967 cp22a pin.

Cp22b notification of cessation of employment employment of public sector employees failure to notify irbm will render an employer liable to prosecution and. 1 2015 tandakan x jika alamat surat menyurat di atas adalah alamat ejen cukai e e pilihan. Cp22a notification of cessation of employment employment of private sector employees cp22b notification of cessation of employment employment of public sector employees failure to notify irbm will render an employer liable to prosecution and on. Form cp22a pin 1 2015 available in malay language only.

If you fail to do so you are liable to prosecution and if convicted liable to a fine of not less than rm200 and not more than rm2 000 or to imprisonment for a. Or the employee was eligible for pcb but no deductions were made. This form is to be sent to any branch of lembaga hasil dalam negeri malaysia where the employee is exercising the employment no. Telefon majikan employer s telephone no.