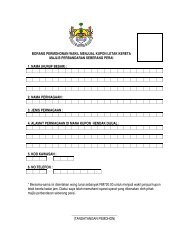

Borang Jked 2

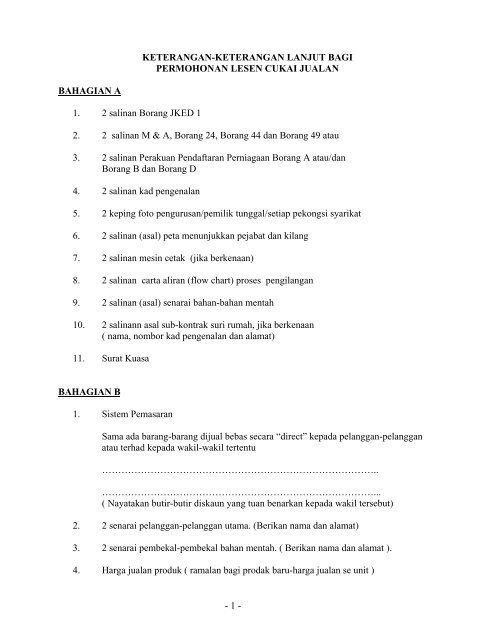

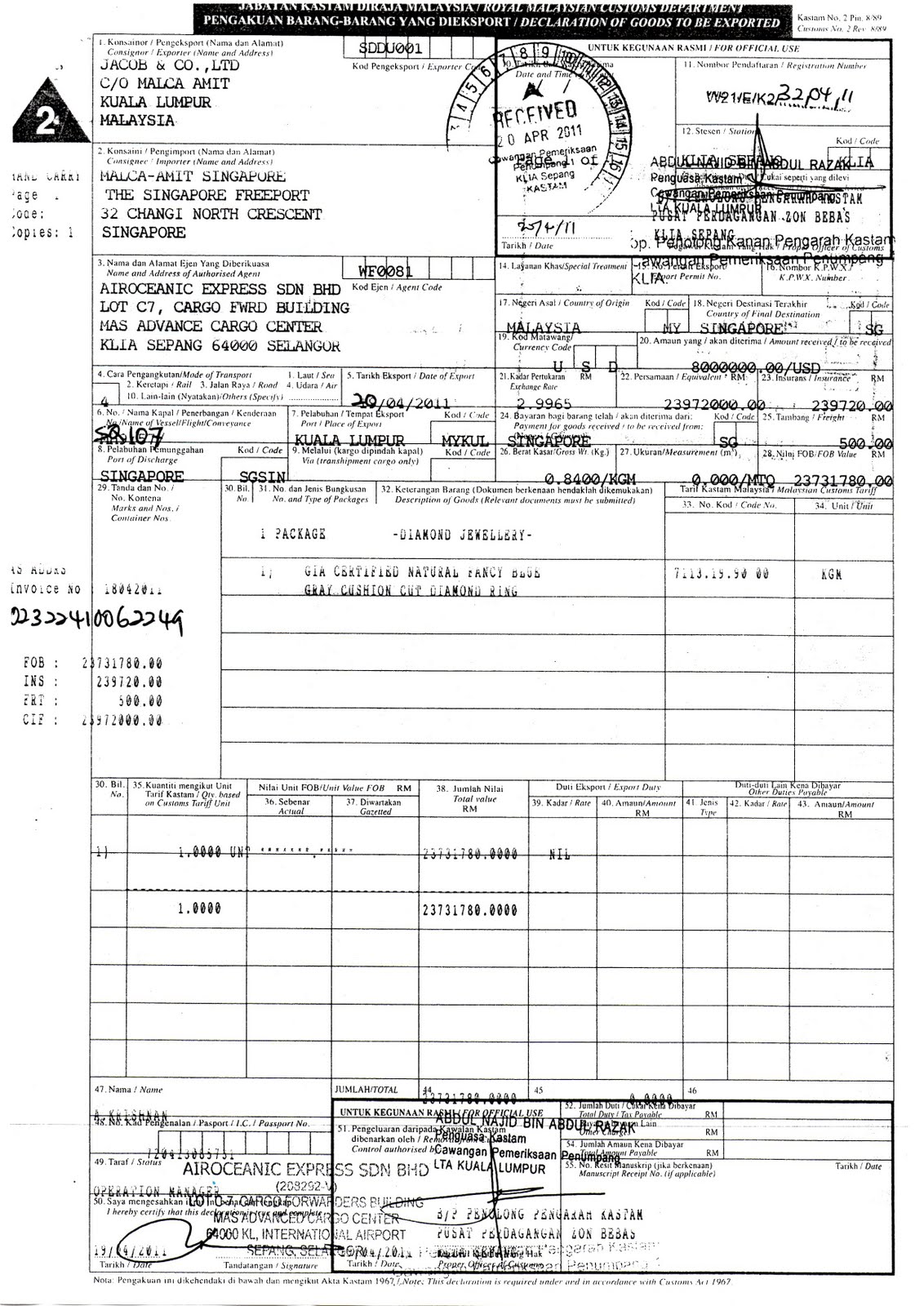

Satu salinan dokumen dokumen yang telah disahkan di bawah akta syarikat 1965 seperti.

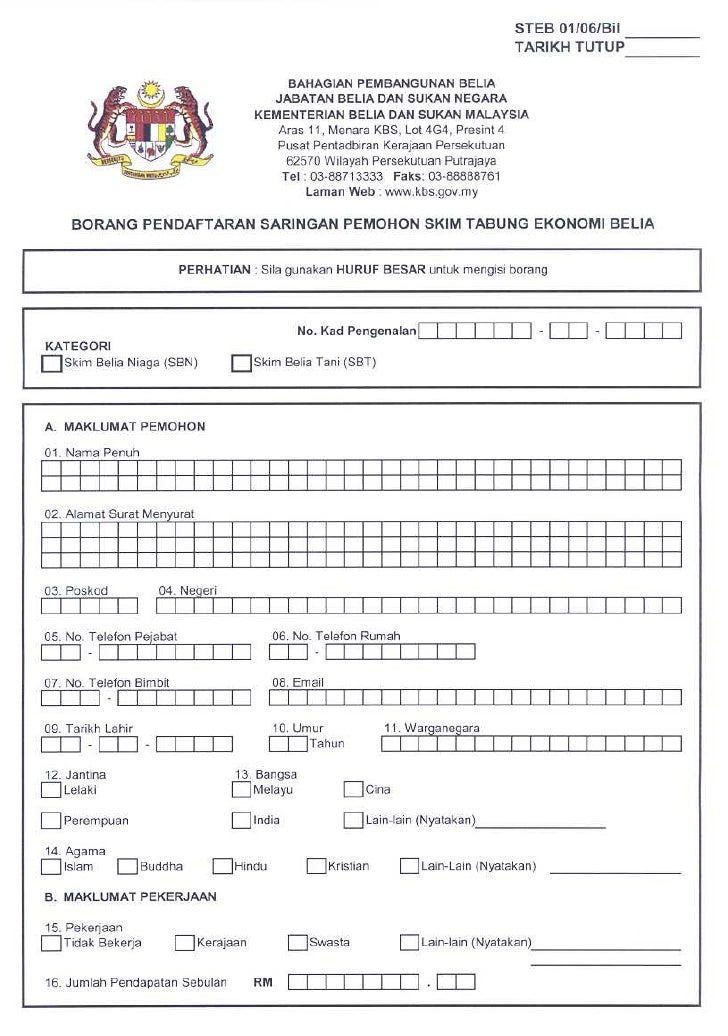

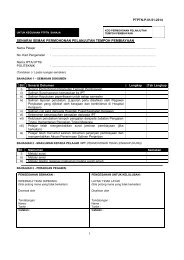

Borang jked 2. Surat permohonan rasmi syarikat. Service tax no 3 service tax return customs composite forms. Surat permohonan rasmi syarikat. 1 jked 1 hendaklah dikemukakan dalam tiga 3 salinan ke pejabat kastam yang terdekat dengan tempat perniagaan dijalankan.

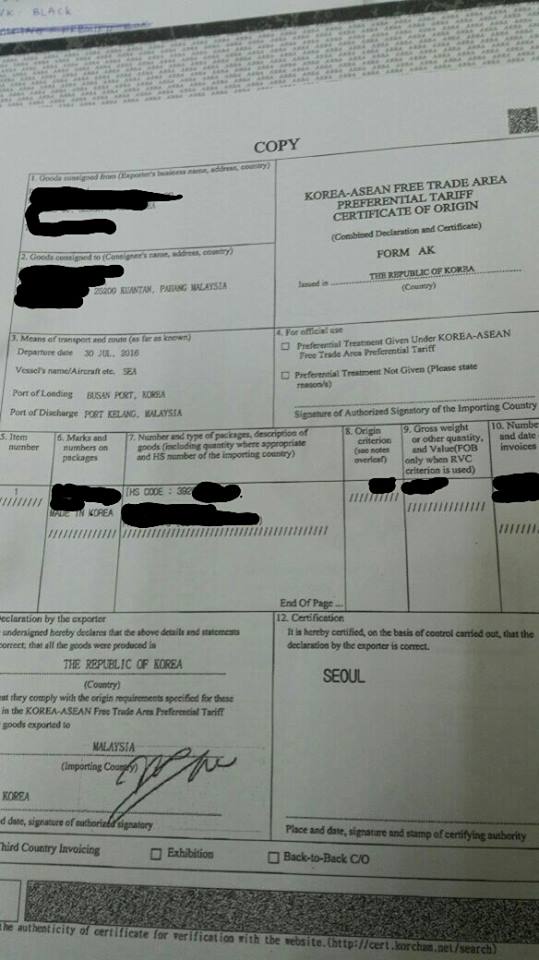

1 2018 jabatan kastam diraja malaysia royal malaysian customs department tuntutan pembayaran balik pulang balik duti cukai lain lain claim for refund drawback of duty tax others nota penting important notes. Customs no 6 transhipment 4. Event calendar check out what s happening. Sales tax no 3 sales tax return cjp 1 9.

Register login gst shall be levied and charged on the taxable supply of. Copy of attachment d approval of duty tax drawback facility iv. Customs no 13 warehouse license jked no 3 5. Gst calculator gst shall be levied and charged on the.

Service tax no 2 service tax license 8. Dokumen dokumen untuk permohonan lesen seperti berikut. Borang kastam 2 bahan bahan mentah yang digunakan jumlah duti yang dituntut seunit barang siap. Hanya satu 1 tuntutan sahaja dibenarkan untuk setiap borang jkdm no 2.

2 claim for refund drawback of duty tax iii. Once the payment is settled the file claims will be. Agency browse other government agencies and ngos websites from the list. Ueu qgs enp mekuod l usgx doo ugîuap doorp ugp îuvk ueäë1pas eus g 1 z 18 1ns bänu1 t iliados uencn 1 uep auek b 0n uep eu 1bn aoqu10n.

Contact us jabatan kastam diraja malaysia kompleks kementerian kewangan no 3 persiaran perdana presint 2 62596 putrajaya hotline. 3 salinan lampiran a permohonan untuk lesen gudang mengilang di bawah seksyen 65 65a akta kastam 1967. Dokumen dokumen untuk permohonan lesen seperti berikut. Customs no 5 outward manifest 3.

Attachment f statement of duty drawback calculations claim v. Complaint suggestion public complaint system. Permohonan lesen secara manual menggunakan borang jked. No 1 jked 1 hendaklah dikemukakan dalam dua 2 salinan ke pejabat kastam yang terdekat dengan tempat perniagaan dijalankan.

2 to customs division the trade facilitation and industries section headquarters senior officer of trade facilitation and industries section will process the complete application and submit the claims to the revenue accounting section headquarters for payment. 3 salinan borang jked 1 boleh didapati dari pejabat kastam yang berdekatan. Sales tax no 2 sales tax license 7.