Borang Tp3 2018

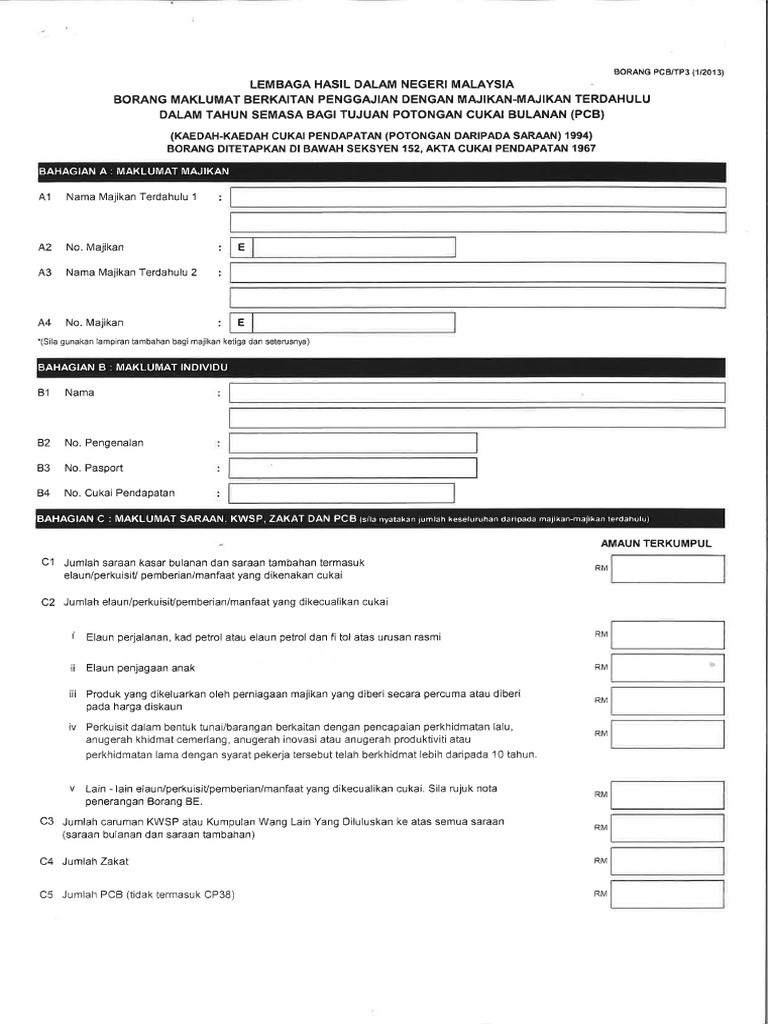

Borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan pcb.

Borang tp3 2018. Do i only need to declare my income pcb from jan 2019 until june 2019 for old company current company. Maklumat majikan a1 nama majikan terdahulu 1. Tp3 as per malaysia inland revenue board irb requirement employee who newly joined the company during the year shall submit tp3 form to his her new employer to notify information relating to his employment with previous employer in the current year. New company require me to fill up borang tp3.

E a3 nama majikan terdahulu 2. What you might not be aware of is that you can actually opt to submit form tp1 to your employers instead of filing your tax returns on march april every year. Borang pcb tp3 1 2017 bahagian a. Or i would need to declare for last year 2018 as well.

Borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan pcb borang tp3 di lawati. E sila gunakan lampiran tambahan bagi majikan ketiga dan seterusnya. Mulai tahun taksiran 2018 syarikat hendaklah mengemukakan anggaran cukai secara elektronik kepada lembaga hasil dalam negeri malaysia. E sila gunakan lampiran tambahan bagi majikan ketiga dan seterusnya.

Maklumat majikan a1 nama majikan terdahulu 1. I will be joining new company on july 2019. Purpose malaysia personal income tax is based on current year annual income. Borang permohonan ini hanyalah untuk.

Form tp1 ensures that your employer takes into account relevant rebates and reliefs such as insurance book purchases and medical expenses to adjust your mtd accordingly thus avoiding them from overpaying tax on your behalf. Borang pcb tp3 1 2019 lembaga hasil dalam negeri malaysia borang maklumat berkaitan penggajian dengan majikan majikan terdahulu dalam tahun semasa bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 acp. Borang pcb tp1 1 2019 lembaga hasil dalam negeri malaysia borang tuntutan potongan dan rebat individu bagi tujuan potongan cukai bulanan pcb kaedah kaedah cukai pendapatan potongan daripada saraan 1994 borang ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 acp bulan potongan tahun potongan bahagian a. E a3 nama majikan terdahulu 2.