Cp 58 Form Lhdn

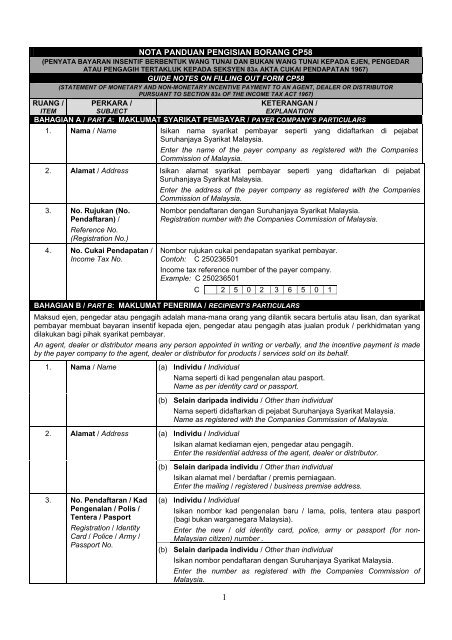

If the payer company elects to furnish form cp58 via electronic medium it must ensure that the form cp58 furnished to its agents dealers or distributors is the same as the form cp58 prescribed by the inland revenue board of malaysia irbm.

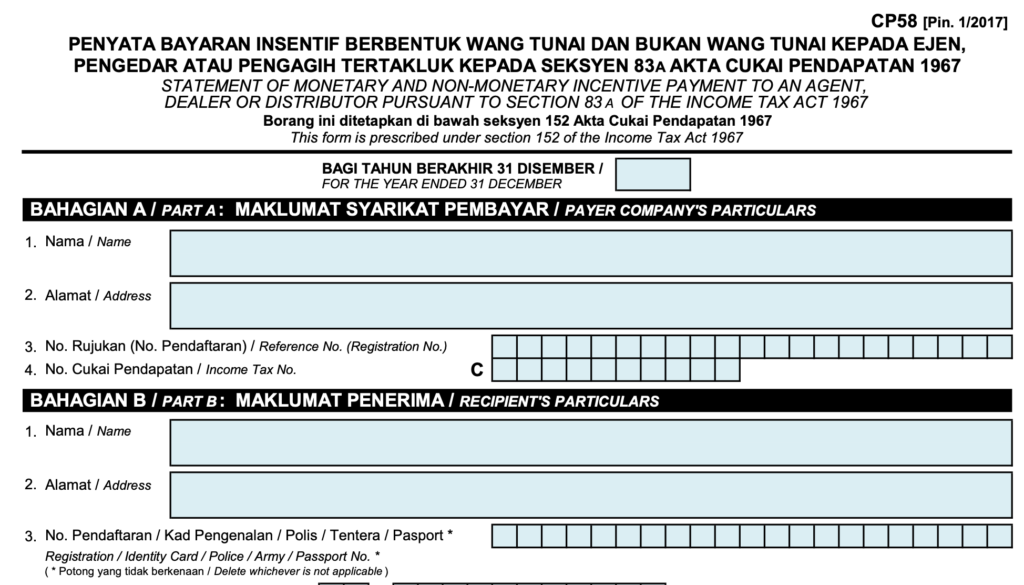

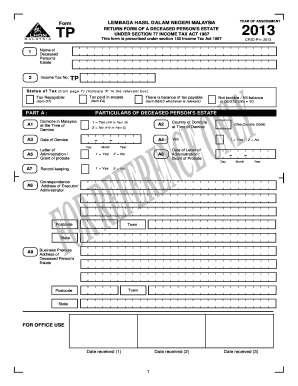

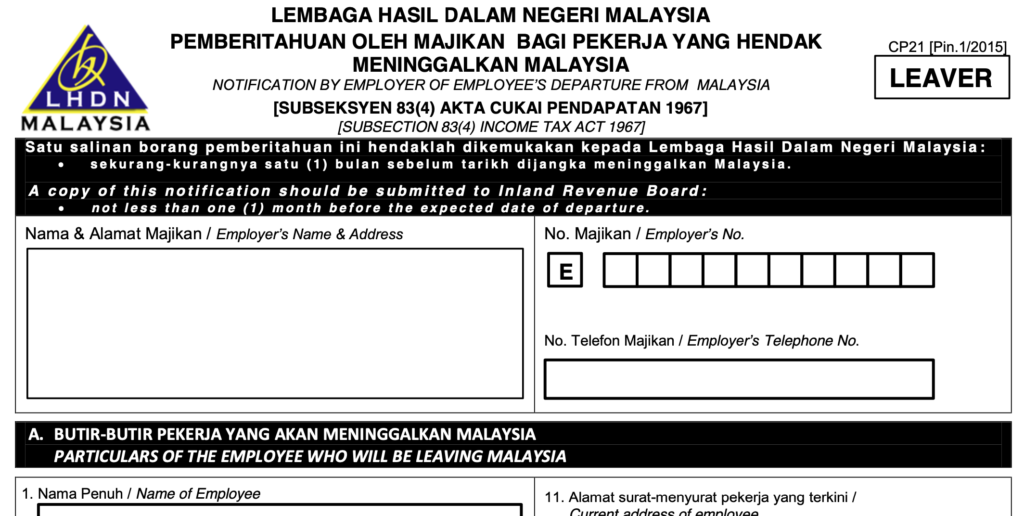

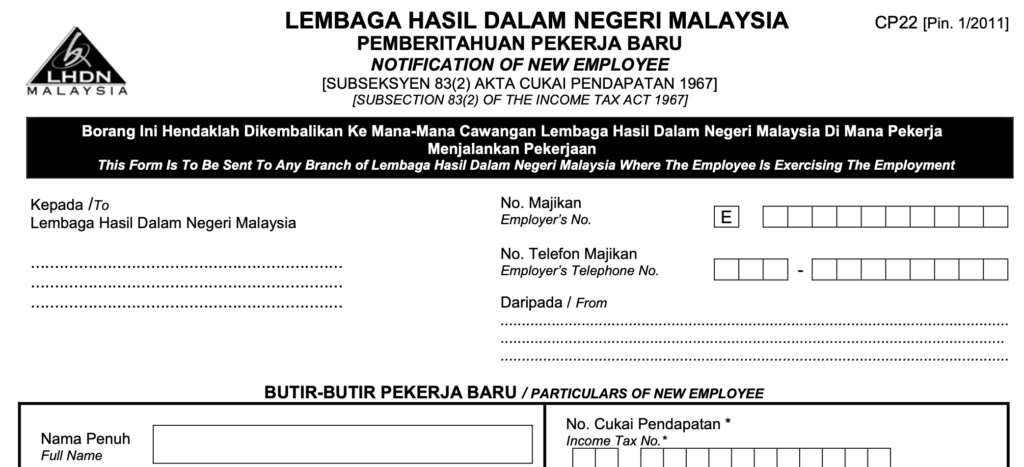

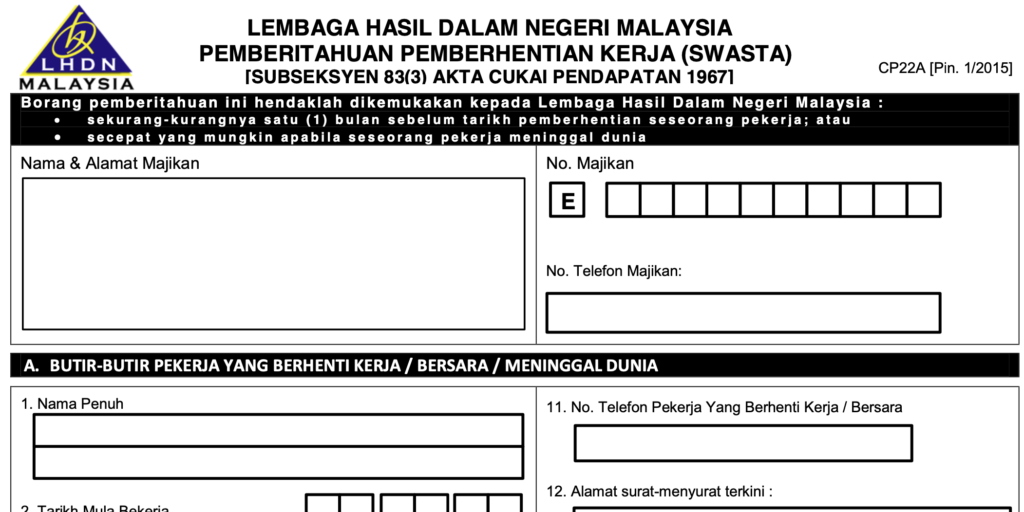

Cp 58 form lhdn. Cp 22a tax clearance form for cessation of employment of private sector employees. Generate form cp 58 with digital signature or electronic stamp of the company. The irb which requires the particulars of payment made by a company whether in monetary form or otherwise to the agents dealers or distributors in a prescribed form form cp58 for incentive payments exceeding rm5 000 s 83a ita 1967 this is only applicable to companies has recently issued a. Don t forget to check out our guide to tax clearance in malaysia to learn who is it for and faqs on cp 21 22 22a 58.

Rujukan cukai tax reference no. Pdf or excel without signature or stamp or. Cukai pendapatan income tax no. Lembaga hasil dalam negeri malaysia kuasa pemfailan penyata secara elektronik authority to file return electronically borang ini ditetapkan di bawah seksyen 152 akta cukai pendapatan 1967 this form is prescribed under section 152 of the income tax act 1967 no.

Cukai pendapatan income tax no. Get the lhdn form you need from the list below. This form is prescribed under section 152 of the income tax act 1967 nama name alamat address no. This form can be downloaded and submitted to lembaga hasil dalam negeri malaysia.

Maklumat penerima recipient s particulars penyata bayaran insentif berbentuk wang tunai dan bukan wang tunai kepada ejen pengedar atau pengagih tertakluk kepada seksyen 83a akta cukai pendapatan 1967 no. Nilai insentif berbentuk wang tunai value of monetary incentive lain lain others sila nyatakan please specify. Pursuant to section 83a 1 of the income tax act of 1967 as of january 1 2012 each company must prepare and provide the cp 58 form to its agents dealers and distributors hereinafter referred to as agents by march 31 of each year in accordance with the format required by lhdn. Form cp 21 leaving the country this form is to notify lhdn on employees leaving the country for more than 3 months.

Lhdn issued new version of form cp58. The payer company is not allowed to. Provide stamped signature on the form cp 58 or. This form is prescribed under section 152 of the income tax act 1967 bahagian b part b.

Pendaftaran reference no. Form cp22a pin 1 2015 available in malay language only. The cp 58 is a prescribed form.