Cp22a Form Download

You ll need to file form 1040x amended u s.

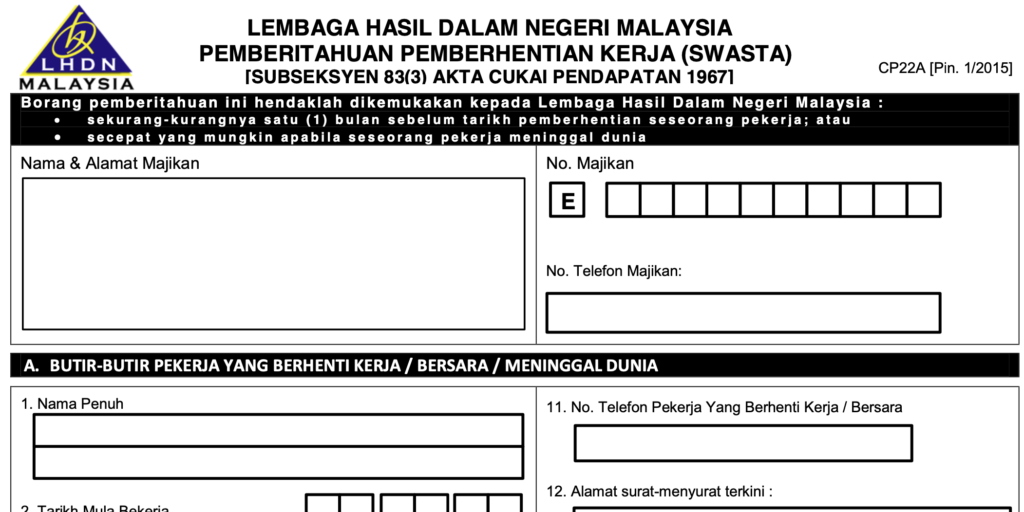

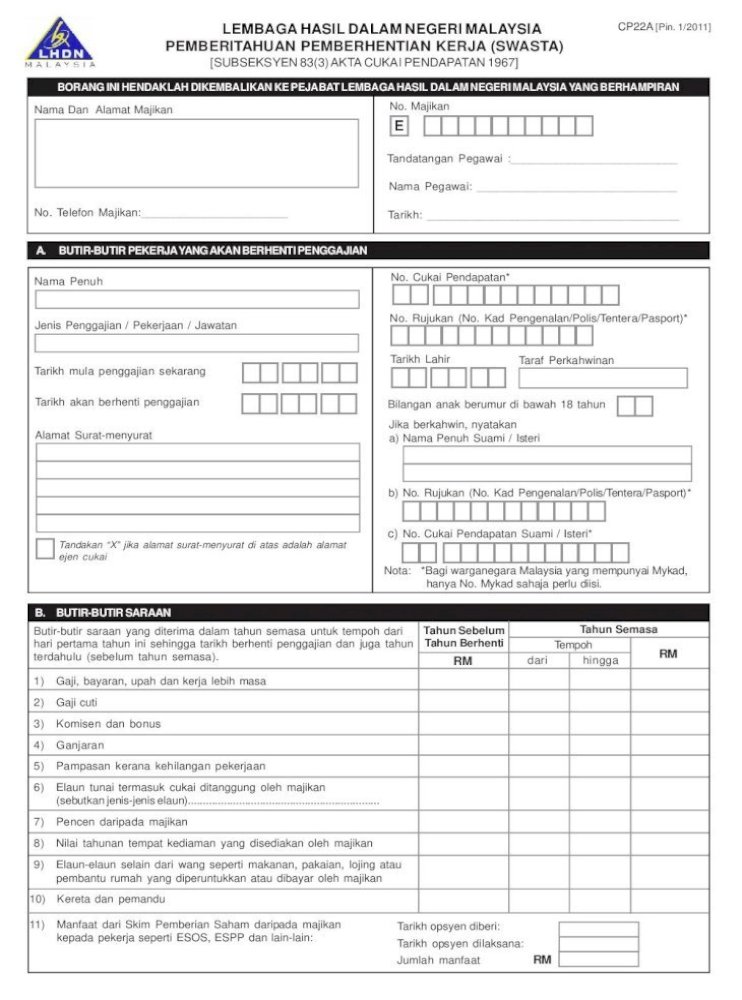

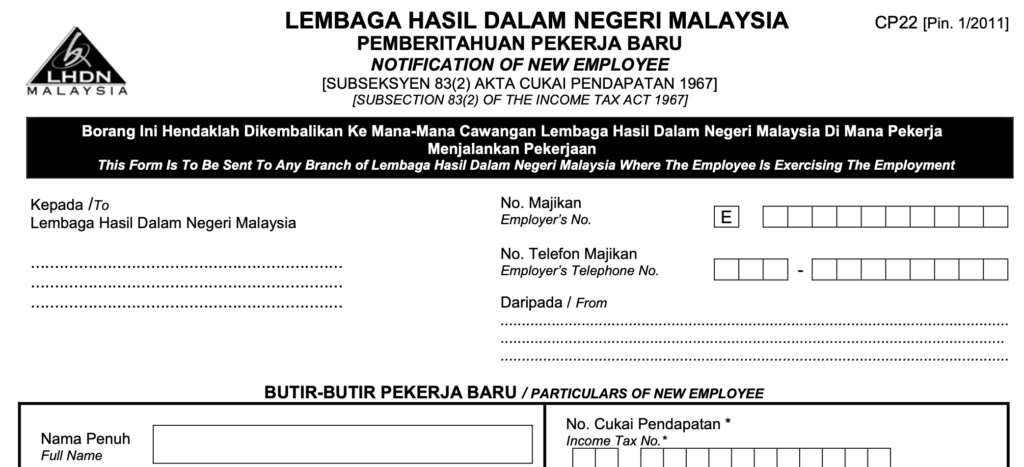

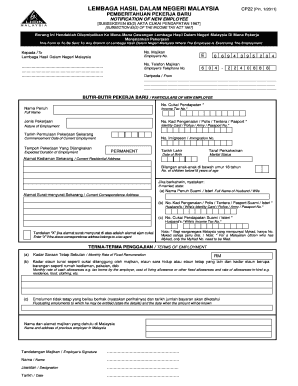

Cp22a form download. 1 2011 pemberitahuan pekerja baru notification of new employee subseksyen 83 2 akta cukai pendapatan 1967 subsection 83 2 of the income tax act 1967. Home download form. Cp 22a tax clearance form for cessation of employment of private sector employees. Guideline for personal tax clearance form cp21 cp22a cp22b.

As an employer are you aware of the reporting obligations under the malaysian income tax act 1967. Retire or cease from employment form cp22a the employer is responsible for notifying irbm at least thirty days before the date the employee ceases employment if a. Income tax cp22 is a form that has to be submitted by the employer to notify lhdn on the newly recruited employees where else income tax form cp22a is a form that is submitted by the employer to notify lhdn on any employees in the cease of employment in forms of retirement or leave malaysia permanently. Notification of the non resident public entertainer.

Call us at the number listed on the top right corner of your notice. What if i haven t been able to get answers after contacting irs several times. Form cp22a pin 1 2015 available in malay language only. In bahasa malaysia it is known as borang pemberitahuan oleh majikan bagi pekerja yang hendak meninggalkan malaysia.

1 2015 tandakan x jika alamat surat menyurat di atas adalah alamat ejen cukai e e pilihan. This form has to be submitted by the employer not less than 1 month before the expected date of departure. It is important to understand the obligations under the law as these obligations are mandatory and failure to comply with these obligations would result in penalties to be imposed. Officially form cp21 is known as notification by employer of departure from the country of an employee.

It is advisable to submit form cp22 to notify irbm for all newly recruited staff within 1 month from the date of commencement. Cp22a form download free what this notice is about we made the changes you requested to your tax return for the tax year on the notice. This material has been prepared for general informational purposes only and is not intended to be relied upon as accounting tax or other professional advice. Individual income tax return.

Subseksyen 83 3 akta cukai pendapatan 1967 cp22a pin. Form perfoma b. Call our taxpayer advocate at 877 777 4778 or for tty tdd 800 829 4059. Carefully read your notice pay the amount owed by the due date or make payment arrangements if you can t pay the.

What if i think i m a victim of identity theft.