Cp8d Form Malaysia

Cp8d pin2016 1 xlsx bahasa malaysia dan bahasa inggeris malay and english language pautan link.

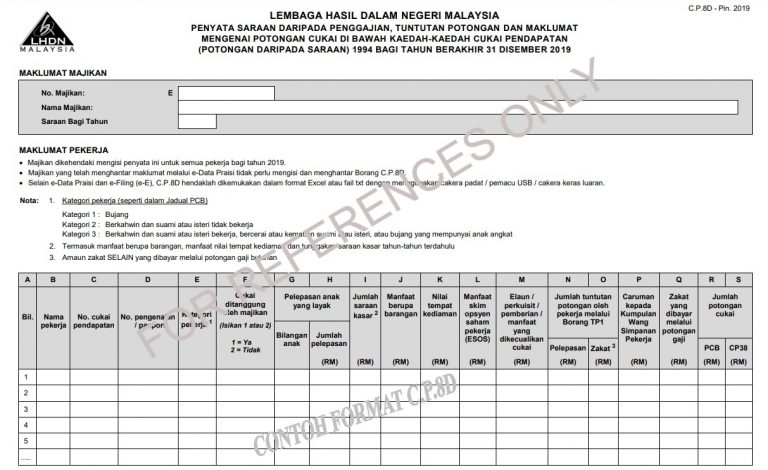

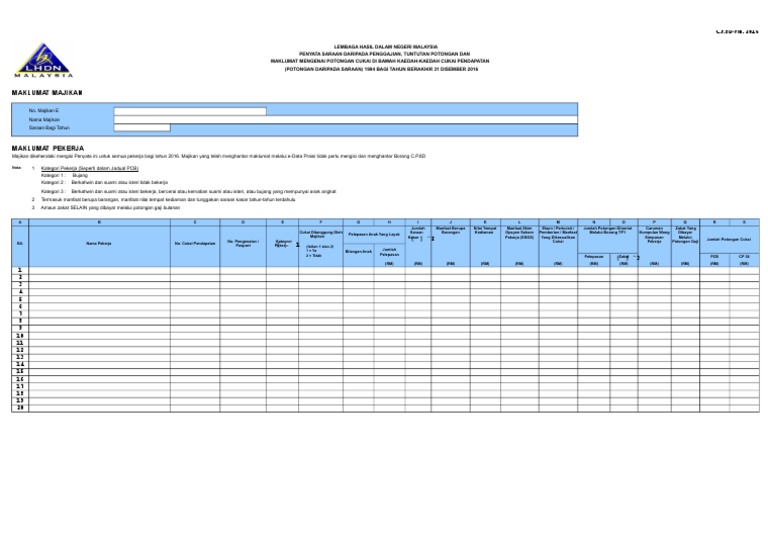

Cp8d form malaysia. Sheet1 nama pekerja nama majikan maklumat majikan maklumat pekerja saraan bagi tahun jumlah potongan cukai c p. Total claim on payment of zakat by employee via form tp1 decimal 11 total payment of zakat other than that paid via monthly salary deduction claimed by the employee via form tp1. Rm12000 90 atau rm12000 20 dilaporkan sebagai 12000. Register an epf account for a company.

Manfaat skim opsyen saham pekerja esos desimal 11 jumlah nilai manfaat esos adalah tanpa nilai sen. Filing program for 2017 tax returns. 8d can still be used for submitting 2016 income. 2016 version of forms ea ec and cp 8d employer related with regards to the amendments of form c p 8d and form ea ec the improvements are made for the purposes.

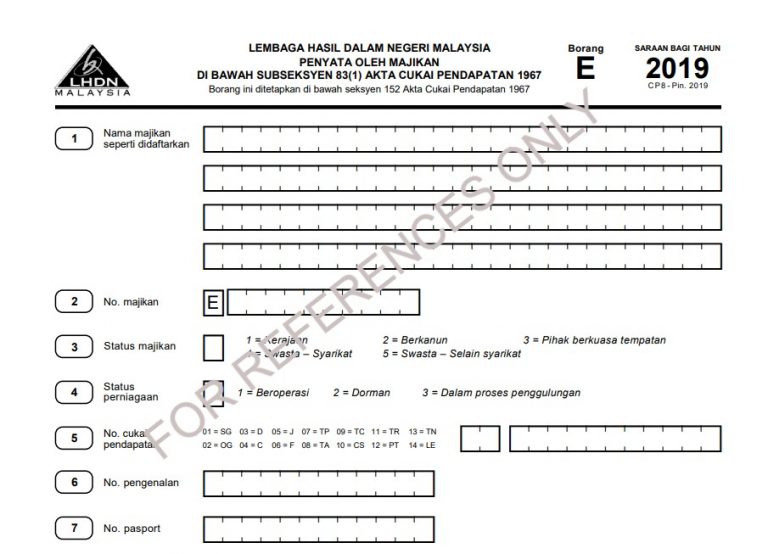

Form e submission on an electronic medium or by way of electronic transmission is obligatory for employers which are companies including labuan companies with effect from the. From lhdn announcement. Failure to do so will result in the irb taking legal action against the company s director. Oleh majikan di malaysia adalah tanpa nilai sen.

Kindly note that minimum fine of rm200 will be imposed by irb for failure to prepare and submit the form e and cp8d to irb as well as prepare and deliver form ea to the employees. Although there is a new ea form for year 2016 lhdn has announced that the the old versions of form ea form ec and c p. The irb has recently updated the following. Rm1300 80 atau rm1300 30 dilaporkan sebagai 1300.

Amendments to form e cp8d ea ec in respect of remuneration for the year 2016. Cp8d is a form to to declare all staffs particulars including salary bonus benefit in kind received by each employee include directors step 6 if you do not using any payroll software please select bersama borang e submit together with e form you will landed on cp8d form. Form e borang e is a form required to be fill and submit to inland revenue board of malaysia ibrm by an employer. The old version of the forms format allowed to be used for the year of remuneration 2016 only is as follows i form ea c p.

Basically its a form of declaration report to inform the irb on the number of employees and the list of employee s income details and must be submitted by 31st march of each calendar year. Form tp1 decimal 11 the total claim for relief by employee via form tp1 excludes the value in sen. Rm2200 50 and rm2200 10 is reported as 2200.