Income Tax Borang Cp22a

Borang permohonan penangguhan bayaran anggaran cukai available in malay language only jenis borang.

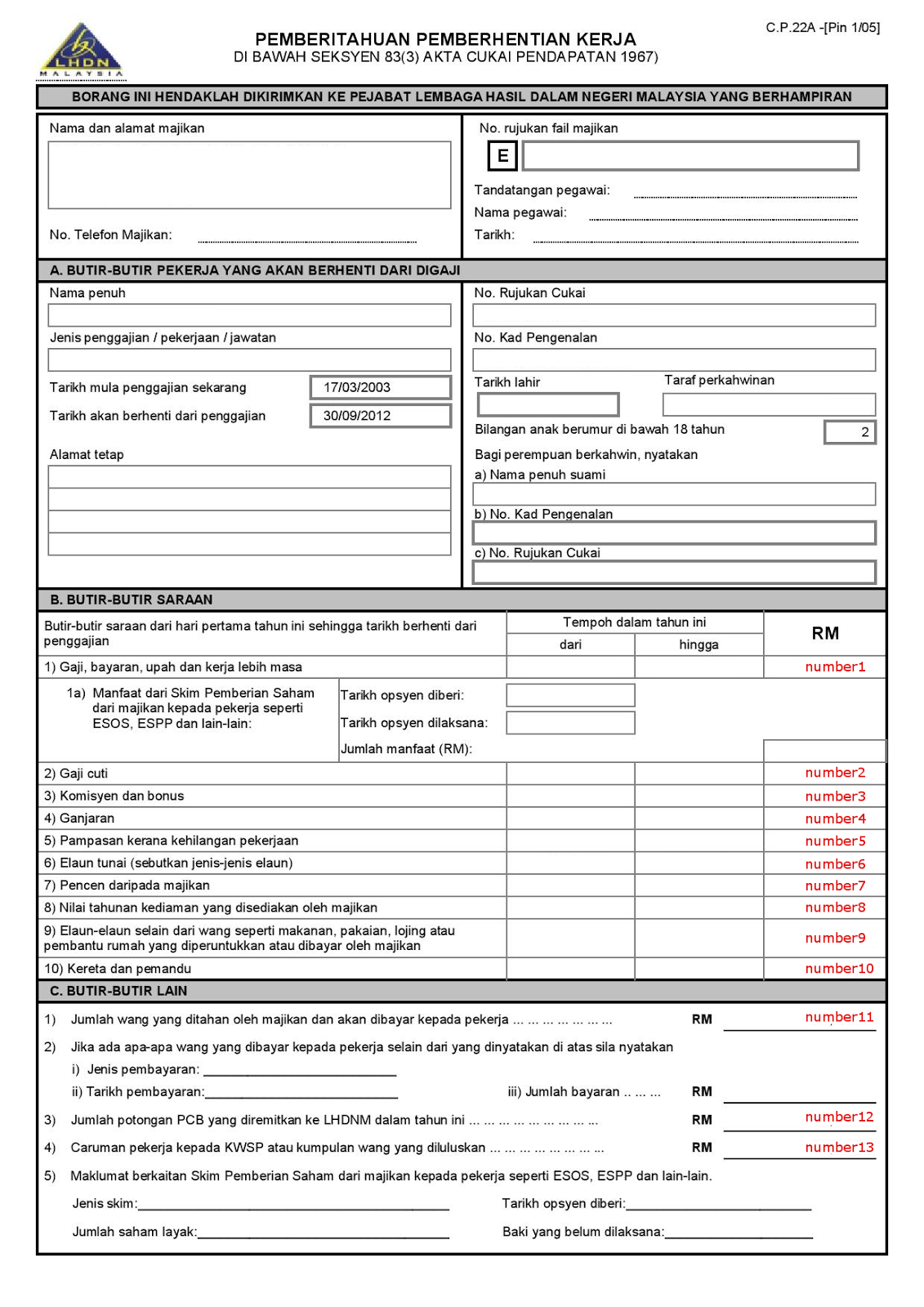

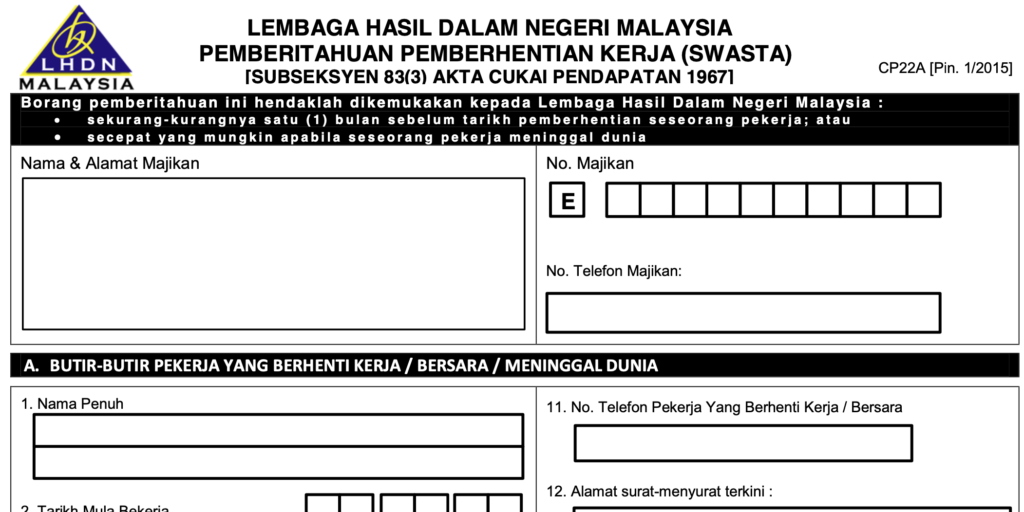

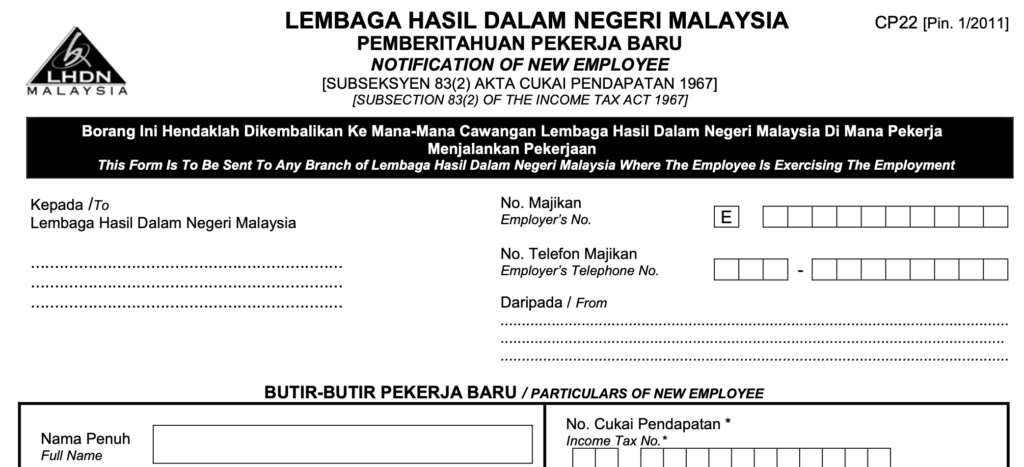

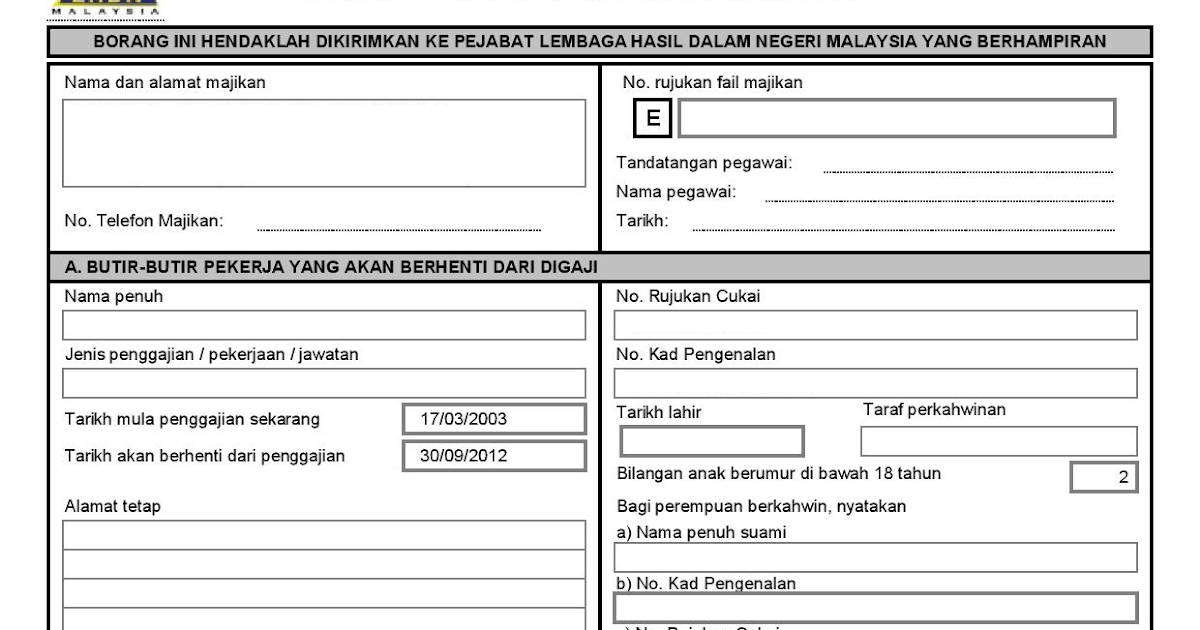

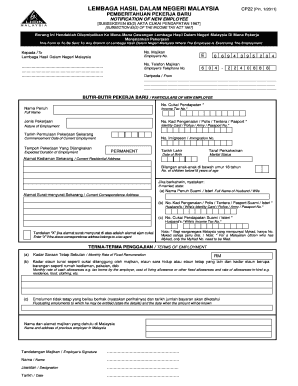

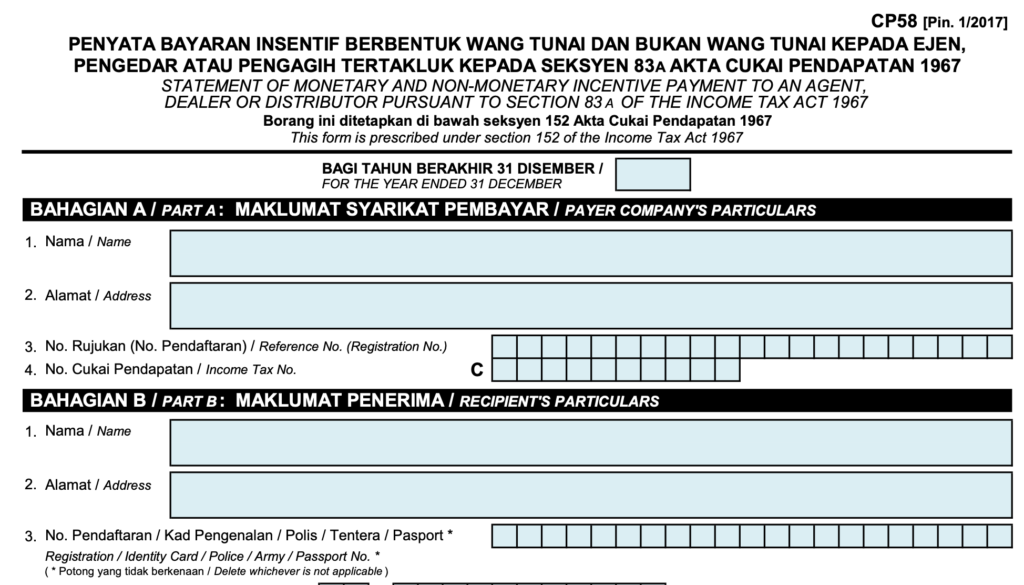

Income tax borang cp22a. 1 2011 pemberitahuan pekerja baru notification of new employee subseksyen 83 2 akta cukai pendapatan 1967 subsection 83 2 of the income tax act 1967. Butir butir pekerja yang akan berhenti kerja bersara meninggal dunia. Recently irbm is enforcing the rules on form cp22 and 22a in relation to the notification for new and resign employee. Part b butir butiran saraan.

Income from sources outside malaysia received by persons in a or b above is exempted from income tax in malaysia according to the act. You might find out some columns are empty when you preview the borang cp22a from payroll system. Application for an approved research project under section 34a of the income tax act 1967. If you want help appealing a cp22a notice request a free consultation.

As an employer are you aware of the reporting obligations under the malaysian income tax act 1967. Mention that you received a cp22a notice with a balance due and you need to review your account. Atau secepat yang mungkin apabila seseorang pekerja meninggal dunia nama alamat majikan no. Simply file form 1040x amended individual income tax return.

This form can be downloaded and submitted to lembaga hasil dalam negeri malaysia. It is important to understand the obligations under the law as these obligations are mandatory and failure to comply with these obligations would result in penalties to be imposed. Form 1 form 2. Yearly remuneration statement ea ec form refer to section 83 1a income tax act 1967 with effect from year of assessment 2009 every employer shall for each year prepare and render to his employee statement of remuneration of that employee on or before the last day of february in the year immediately following the first mentioned year.

Thus we would like to highlight the following for your immediate attention notification of new employee form cp22 the employer must notify the nearest assessment branch within one month from the date of commencement of employment of an individual who is subject to or may. What if i haven t been able to get answers after contacting irs several times. That puts you in contact with reputable tax professionals who can help you appeal tax debt set up payment plans apply for penalty reduction and more. Butir butir pendapatan yang belum dilaporkan and.

Individual income tax return. Guideline for personal tax clearance form cp21 cp22a cp22b. Call our taxpayer advocate at 877 777 4778 or. For columns highlighted below please fill in based on own record.

Form cp22a pin 1 2015. Sekurang kurangn ya satu 1 bulan sebelum tarikh pemberhentian seseorang pekerja.